An American First. It’s the Law in WA: Accrued Holding Gains are Income

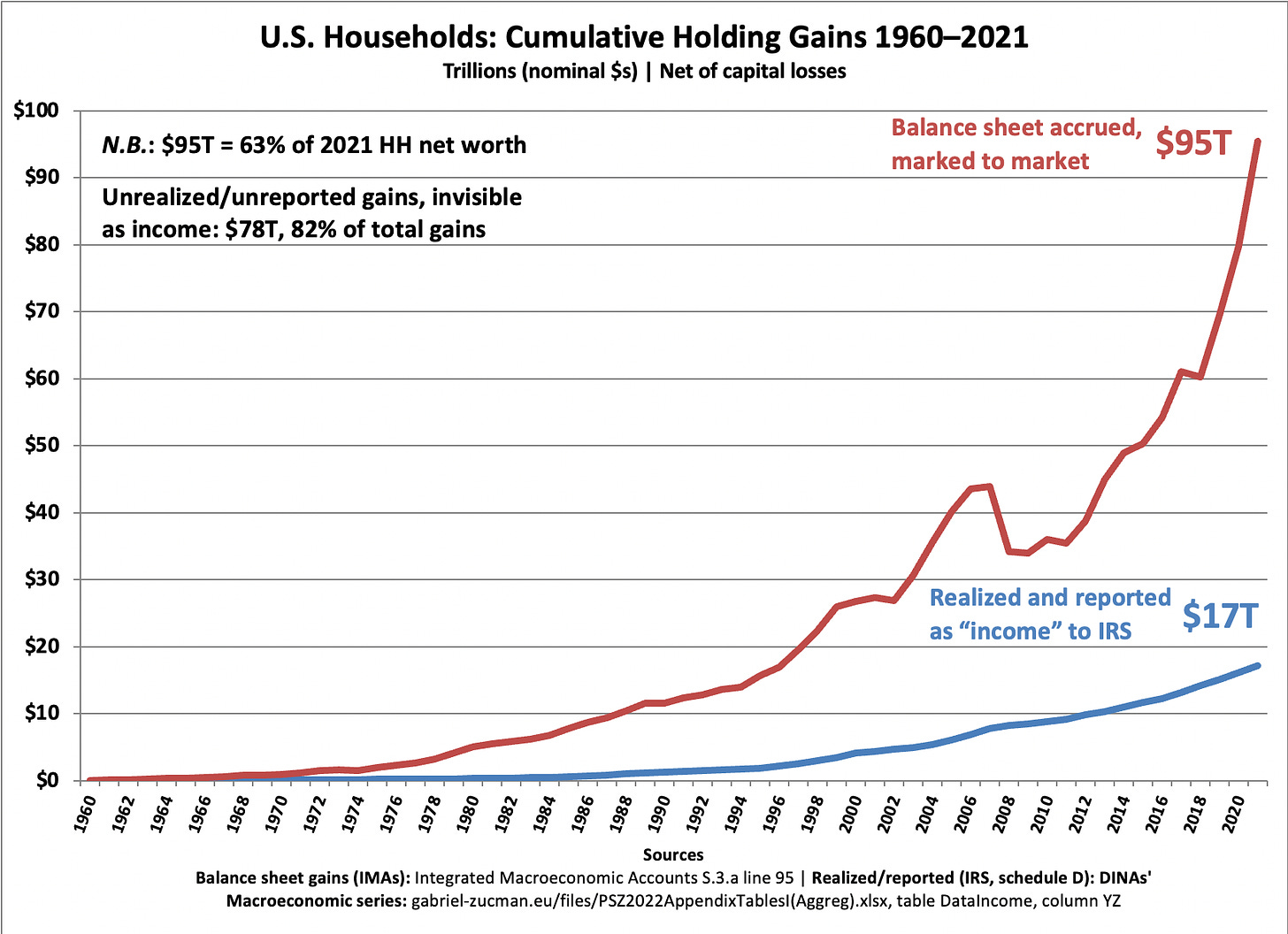

Excluding these massive ”economic flows” from income simply doesn't make any sense, in basic accounting terms.

Starting with the 2022 tax year, Washington State implemented a first-in-the-nation (7%) tax on accrued holding gains exceeding $250M, payable in 2023. Full props to the Economic Opportunity Institute for spearheading this effort.

The usual suspects challenged the tax in court, saying it’s a tax on property, not income or revenue. In March the Washington State Supreme Court disagreed, in a 7-2 opinion. They said it’s an “equity tax,” like Washington’s taxes on business revenues.1

In simple terms, accrued holding gains are income for households, so they’re taxable under state law.

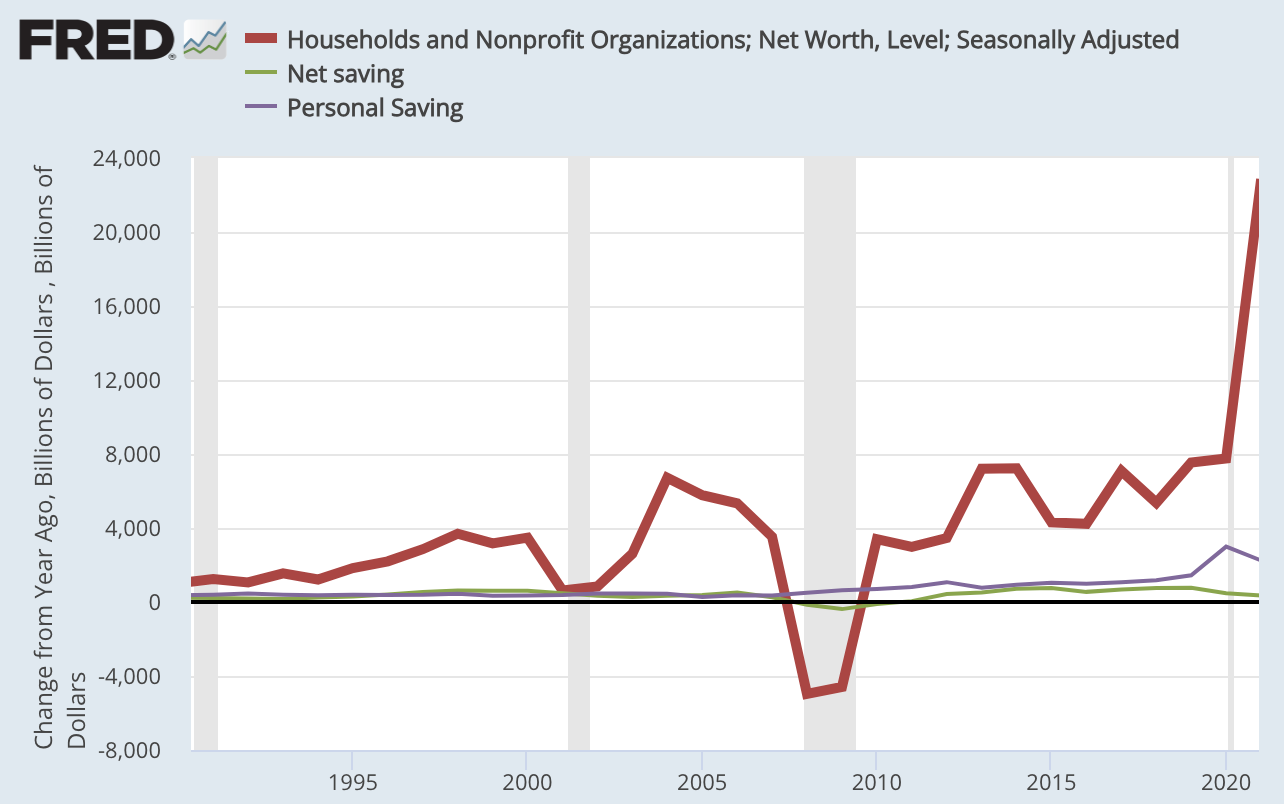

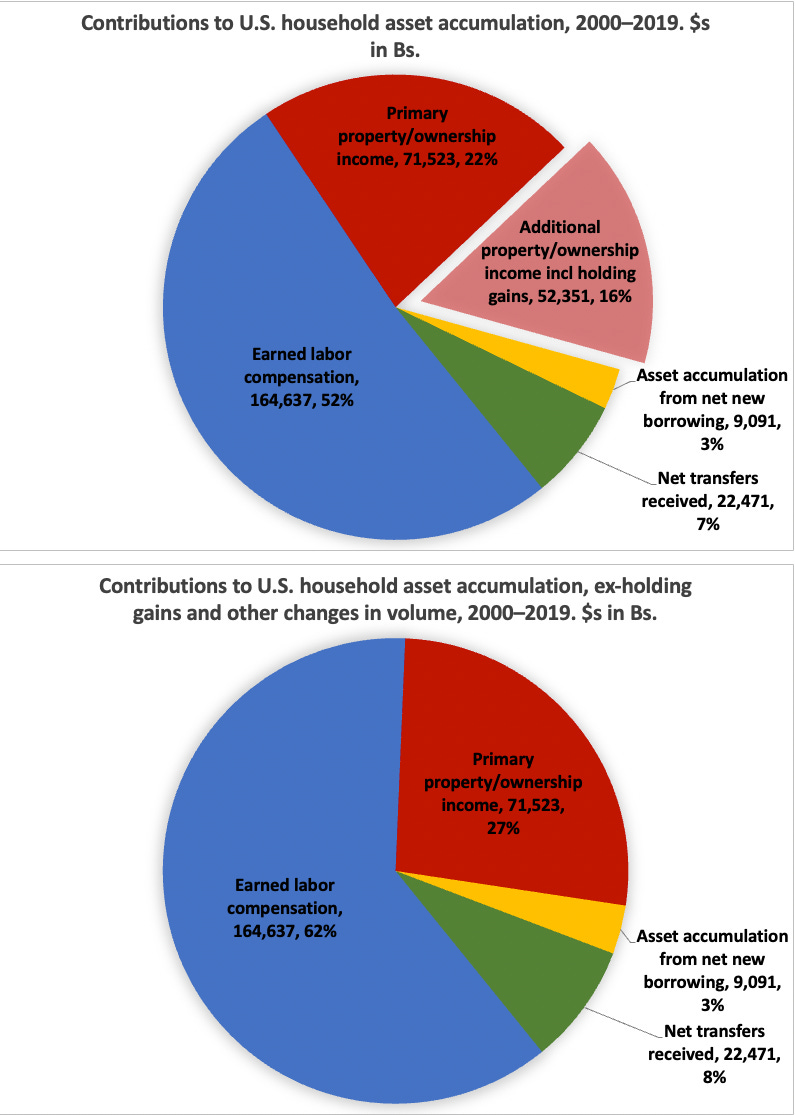

This makes perfect sense. For nearly a century, economists have been referring to “Haig-Simons” income, which includes accrued holding gains, as the “preferred” measure of income.2 And with very good reason: If “income” doesn’t include holding gains, then income minus spending (saving) doesn’t even come close to explaining the accumulation of household assets and net worth — wealth.

The red line is the annual change in wealth. The others are annual saving measures. Saving doesn’t explain wealth accumulation. It’s contrary to basic accounting arithmetic. The flows are supposed explain the changes in stocks. Income statements explain balance sheets.

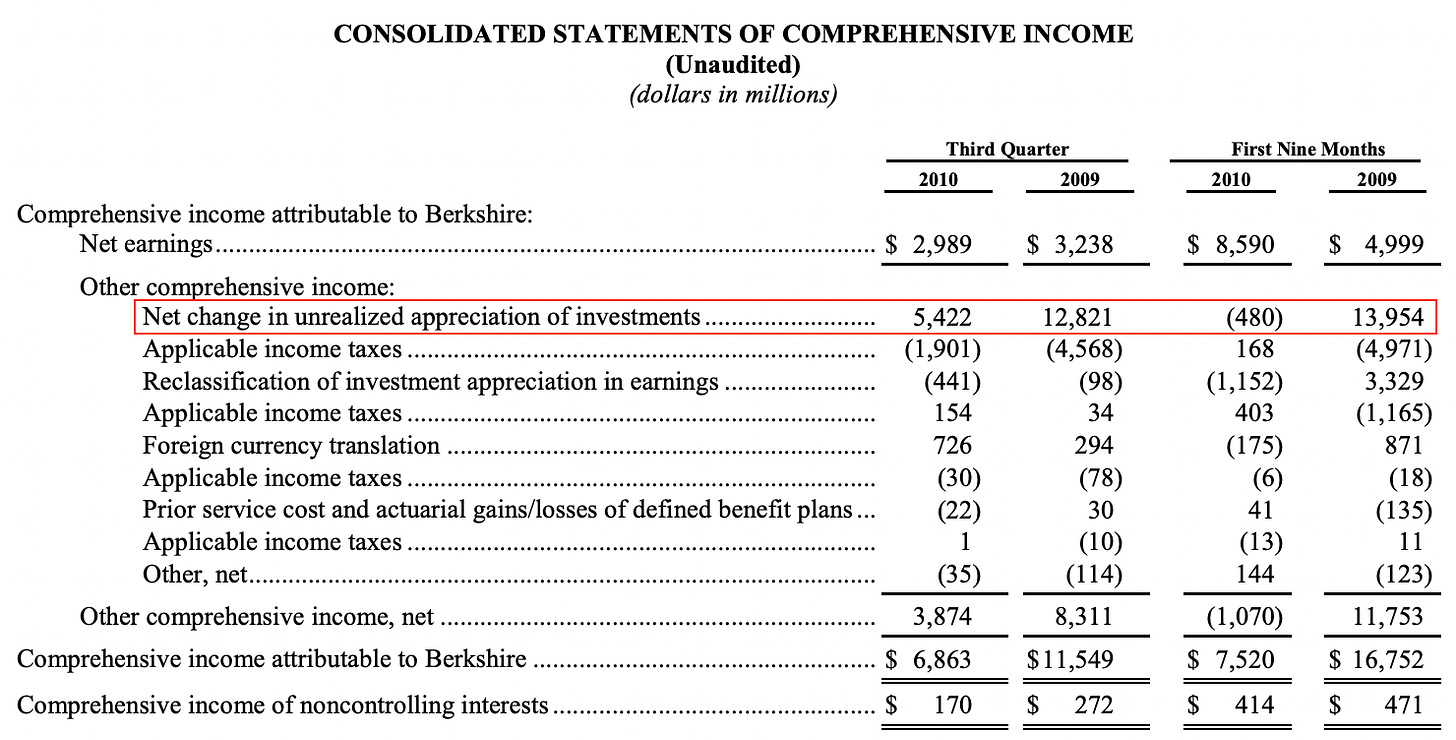

And it’s completely contrary to standard, comprehensive corporate accounting practice. Here, Berkshire-Hathaway for instance.

The Fed’s Flow of Funds accountants fully acknowledged this reality with a terminology change and release note to the Q1 2018 Financial Accounts release,3 embracing full modern national-accounting treatments of “economic flows” that include both “volume” (transaction) and “(re)valuation” flows.

In his 1939 Value and Capital, Sir John Hicks devoted a whole chapter to Haig-Simons income (though not by that name). In a 2009 paper, Emmanuel Saez and Gabriel Zucman refer to Haig-Simons income (again not by that name) as “true economic income.” (Nine times.) Well named. There’s a “massive economic literature” on this subject that few economists are even aware of.

This Washington State ruling is a Really Big Deal.

So How’s It Working Out?

State Department of Revenue projections predicted there would be 3,200 “payers” of the capital gains tax in 2023, and $248M in tax revenues. So far, “6,012 capital gains accounts have been registered with the state Department of Revenue, 1,605 returns have been filed, and 3,457 payments have been received for the $859 million total.” (Randy Bracht | The Center Square.)

Many big cap-gain recipients file extensions while waiting for K-1 reports from private LLCs and etc. in which they hold shares. So final numbers won’t be available until after the Oct. 16 extension deadline.

But it’s a very good start.

On August 21 the Olympia-based Freedom Foundation filed an appeal of that decision, seeking certiorari with the U.S. Supreme Court.

See pp. 2–3 here: https://mpra.ub.uni-muenchen.de/115948/

"Flows" now referred to as "transactions" — As of this publication, the term "flow" is being replaced by the term "transactions." The concept being referred to, which is the acquisition of assets or incurrence of liabilities, is not being changed. The change in terminology is intended to prevent confusion with the broader concept sometimes called "economic flow," which is the change in level from one period to the next and is composed of transactions, revaluations, and other changes in volume. The new terminology brings the Financial Accounts of the United States into better alignment with international guidelines in the System of National Accounts 2008 (SNA2008).