Wealth Accumulation During Covid: Who Got the Money?

Top-1% household wealth grew by $64M per household, up 46%

The new release of the Distributional Financial Accounts (DFAs) is out, covering Q4 of 2022. It lets us see the distributional breakout of all the new wealth accumulated during the Covid era, discussed in the previous post. (After a one-quarter asset-market downturn, starting in Q2 2020 household assets increased quite massively for the next seven quarters. They’re down a bit since then.) The spreadsheet for this post is available here.

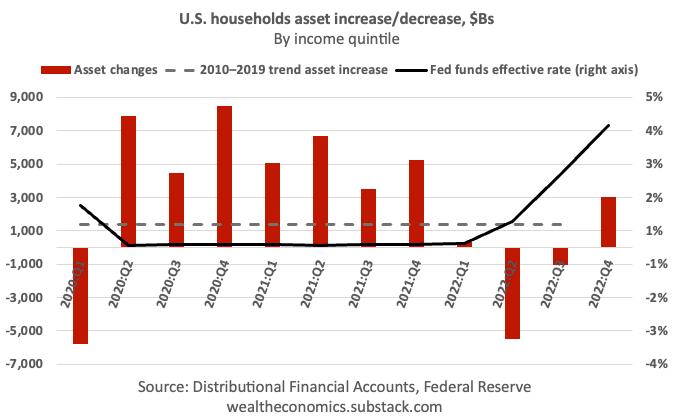

Who got that wealth? Here’s the quarterly increase/decrease, by income quintile.

For reference, the trend increase for 2010-2019 was flat at $1.3T per quarter.

What explains such a big jump extending over seven quarters, at a time when global economic activity had cratered? The (relatively) measly $4.6T in fiscal stimulus doesn’t do it; we’re looking at $3T to $8T increases per quarter.

It’s hard not to point to the Fed’s zero-interest rate policy (ZIRP). “Spiking the punch bowl,” indeed.

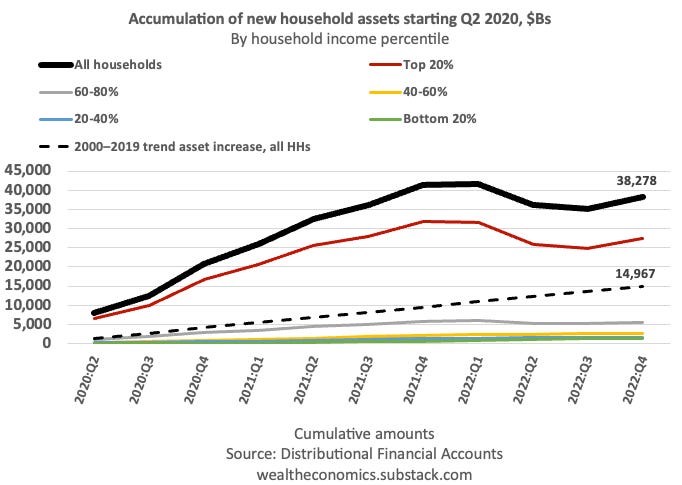

Here’s the total, cumulative household asset accumulation over eleven quarters, since the Fed went all be-ZIRP on the Covid crash (then hiked). Total assets are up $38T, 32%. (At the peak it was $42T, 35%.1)

Looking at increases for the average household in each quintile, every quintile accumulated quite a lot relative to their starting asset levels. (For reference, average assets for bottom-20% households started at $215,000.)

Not surprisingly, the top 20% was the biggest quintile winner in percentage terms — and of course in dollar terms; they own most of the assets that appreciate due to asset-price runups. The percentage discrepancies are not so large, though; other quintiles got 24%-30% wealth bumps. Especially: the bottom 20% outperformed the 20-80% group, and its $65K average dollar increase is a big number for a group that on average started with $215K.

But what really stands out is the top 1%: up $64M per household, 46%. Matthew Effect, much?

For whoever has, to him more will be given. —Matthew 13:12

Slightly different from the $43T reported in the previous post, probably due to the DFAs’ different (and changing) treatment of pension entitlements qua assets.